Managing a fleet requires some tough decisions, and one of the biggest is whether to buy or lease vehicles. This choice impacts everything that follows, from financial planning to maintenance strategies and long-term efficiency. In this blog, we break down the financial implications, compare ownership vs. leasing, and explore the growing shift toward EV fleets. We’ll also look at the advanced fleet management technology that helps you get the most out of vehicle ownership and optimize your fleet operations.

The Financial Impact of Fleet Ownership

Buying fleet vehicles requires significant capital, but the long-term financial picture is more complex—especially as your operation grows and variable costs rise. Let’s take a look at the four main silos that hold financial implications.

Upfront Costs and Capital Investment

It takes a substantial amount of cash to buy a fleet vehicle outright, but financing it with a loan adds a major line item to the monthly budget. It comes down to finding the right balance. Coming up with a larger down payment might strain cash flow in the immediate term, but it also reduces monthly lease payments or terms. On the other hand, a smaller down payment keeps some capital in your pocket now but may spell trouble down the road as payments stretch on for years.

Maintenance and Repair Costs

Owning vehicles certainly doesn’t mean being free of costs. Owners bear the full burden of fleet maintenance and repairs—whether scheduled or unexpected. Therefore, it’s important to consider the condition of the vehicles being purchased, as older vehicles are more affordable but may increase maintenance expenses over time. Spending more on newer vehicles may put a larger dent in the capital budget today but prove more valuable over the long haul.

Depreciation and Resale Value

It’s an irritating reality, but we know fleet vehicles lose value over time and depreciate as mileage accumulates on their odometers. Reselling them to recoup some of the initial investment is possible, but resale depends on volatile market dynamics and vehicle conditions. Some reputable and reliable brands hold value better, but forecasting resale prices is challenging. It’s important to consider depreciation and resale values as you make decisions about purchasing or leasing fleet vehicles.

Tax Implications

The decision to lease fleet vehicles versus own them can have a major impact on your tax liability. Ownership allows depreciation deductions and potential tax benefits, while leasing typically excludes these rebates. However, some leases may offer different tax advantages by allowing you to deduct the cost of monthly payments, so it’s important to ask questions and run the numbers as you weigh the options.

Buying vs. Leasing: Weighing the Pros and Cons

Beyond financial considerations, fleet managers have to evaluate flexibility, total cost of ownership, and operational needs. Buying gives fleets full control over vehicles, with no mileage limits or lease restrictions, while leasing offers lower upfront costs and visible monthly expenses. But there are some detractors to both of these options as well. Let’s take a comparative look at the pros and cons of both buying and leasing.

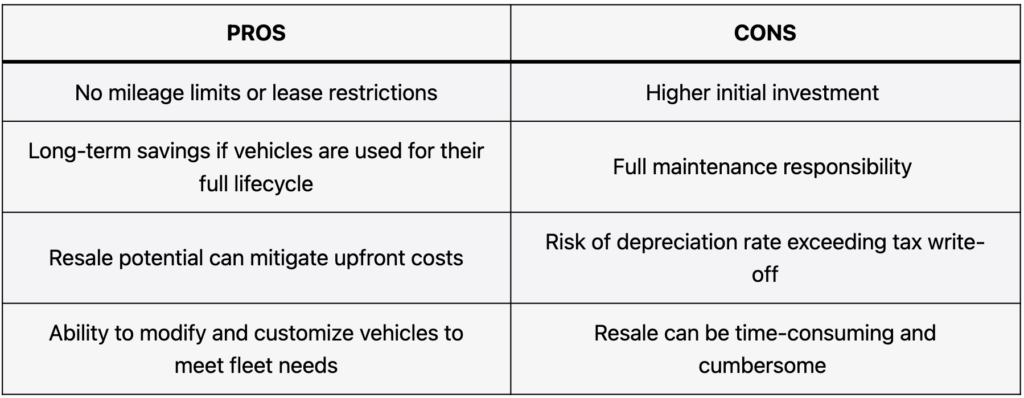

Buying Pros and Cons

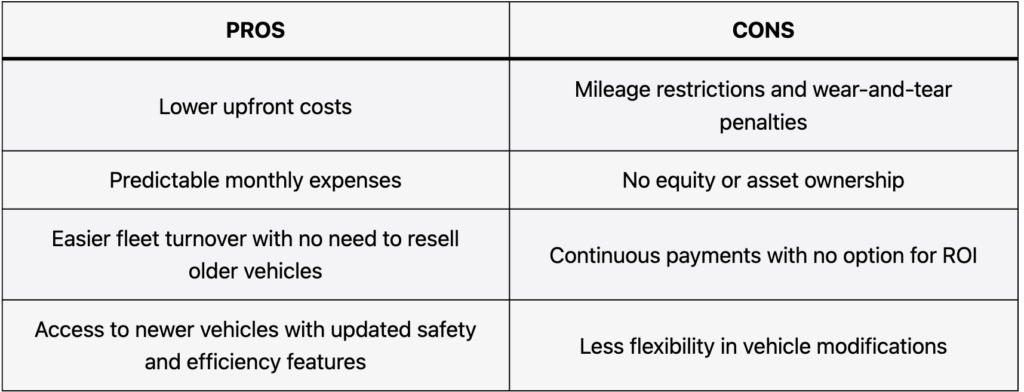

Leasing Pros and Cons

Electrifying Your Fleet: Ownership Considerations

As fleets transition to electric vehicles (EVs), the buy vs. lease debate takes on new dimensions. EV fleets are becoming an increasingly popular choice, and it’s not just a passing trend. EVs inherently produce fewer emissions, reducing harmful greenhouse gasses and the company’s carbon footprint. EVs can also be more cost-effective than diesel vehicles in the long run since they use less fuel and often require less frequent maintenance.

There are other advantages, too, like regulatory incentives. Many governmental agencies offer subsidies, tax benefits, and other incentives to encourage the adoption of EVs. Also, companies that utilize EVs demonstrate a visible commitment to the environment that boosts their brand image in the public eye.

By adopting EV fleets early, companies can position themselves at the forefront of innovation and environmental responsibility. The move to EVs helps in sustainability metrics and sets a fleet up for more efficient and forward-thinking operations.

Ownership vs. Leasing for EVs

Federal tax incentives for new, used, and commercial electric vehicles make purchasing the clearer choice for many fleets. Across the United States, there are hundreds of state and local EV purchasing incentives, as well as local, state, and federal rebates available for EV charging at qualifying businesses.

Leasing EVs, on the other hand, may be attractive due to evolving technology and uncertain battery longevity. While buying provides full control over charging infrastructure and long-term cost savings, leasing offers more flexibility to evolve with emerging technology.

Charging Solutions and EV Infrastructure

Understanding how, when, and where to charge electric vehicles is critical to EV fleet management. The decision to build a private charging network versus relying on public chargers dramatically impacts costs and capital expenditures. Fleet managers have to evaluate the type and number of chargers needed to support fleet activities and routes, as well as the cost of electricity. Charging infrastructure and strategically placed onsite and offsite chargers ensure accessibility and minimize downtime, making it an important part of planning EV transitions.

Optimizing Fleet Ownership with Solera Fleet Solutions

Omnitracs, now a part of Solera Fleet Solutions, delivers innovative tools designed to optimize fleet ownership by improving efficiency, tracking maintenance, and reducing downtime. With automated ELD management, fleets can maintain accurate records while reducing the risk of violations. Advanced route optimization tools provide the adaptability to overcome scheduling challenges and meet delivery goals. Solera’s cutting-edge solutions include:

- Omnitracs SmartIQ: SmartIQ transportation intelligence enables your teams to measure and improve driver performance and reduce fuel expenses, all while gaining better visibility into fleet operations.

- Predictive Analytics: Omnitracs Predictive Analytics identifies patterns from telematics data so you can identify risky driver behavior, mitigate future accidents, and control costs.

- Omnitracs Telematics: Fleet telematics integrates telecommunications and informatics to collect, transmit, and analyze data from fleet vehicles and enables real-time tracking, performance monitoring, and data-driven insights that improve operational efficiency and enhance safety.

Solera Fleet Solutions’ suite of fleet management tools helps you monitor and simplify daily operations and workflows. Asset management and maintenance solutions track vehicle maintenance histories and send automated notifications when vehicles are due for service. Plus, predictive maintenance technology allows you to track issues and repairs over time for each asset, helping you to proactively assess vehicles that are underperforming and predict future maintenance needs so you can better evaluate when it may be time to retire them from your fleet.

Whether you decide to buy or lease your fleet vehicles, you can take the complexity out of fleet management with the right partner on your side. Schedule a consultation today and discover how Omnitracs and Solera Fleet Solutions help you improve safety, efficiency, and profitability.